Child Tax Credit 2014 Irs – The child tax credit (CTC) is a nonrefundable tax credit available to taxpayers with dependent children under the age of 17. The maximum tax credit per qualifying child is $2,000, while the . Half a million or more children would be lifted above the poverty line when the proposal is fully in effect in 2025. .

Child Tax Credit 2014 Irs

Source : winknews.com

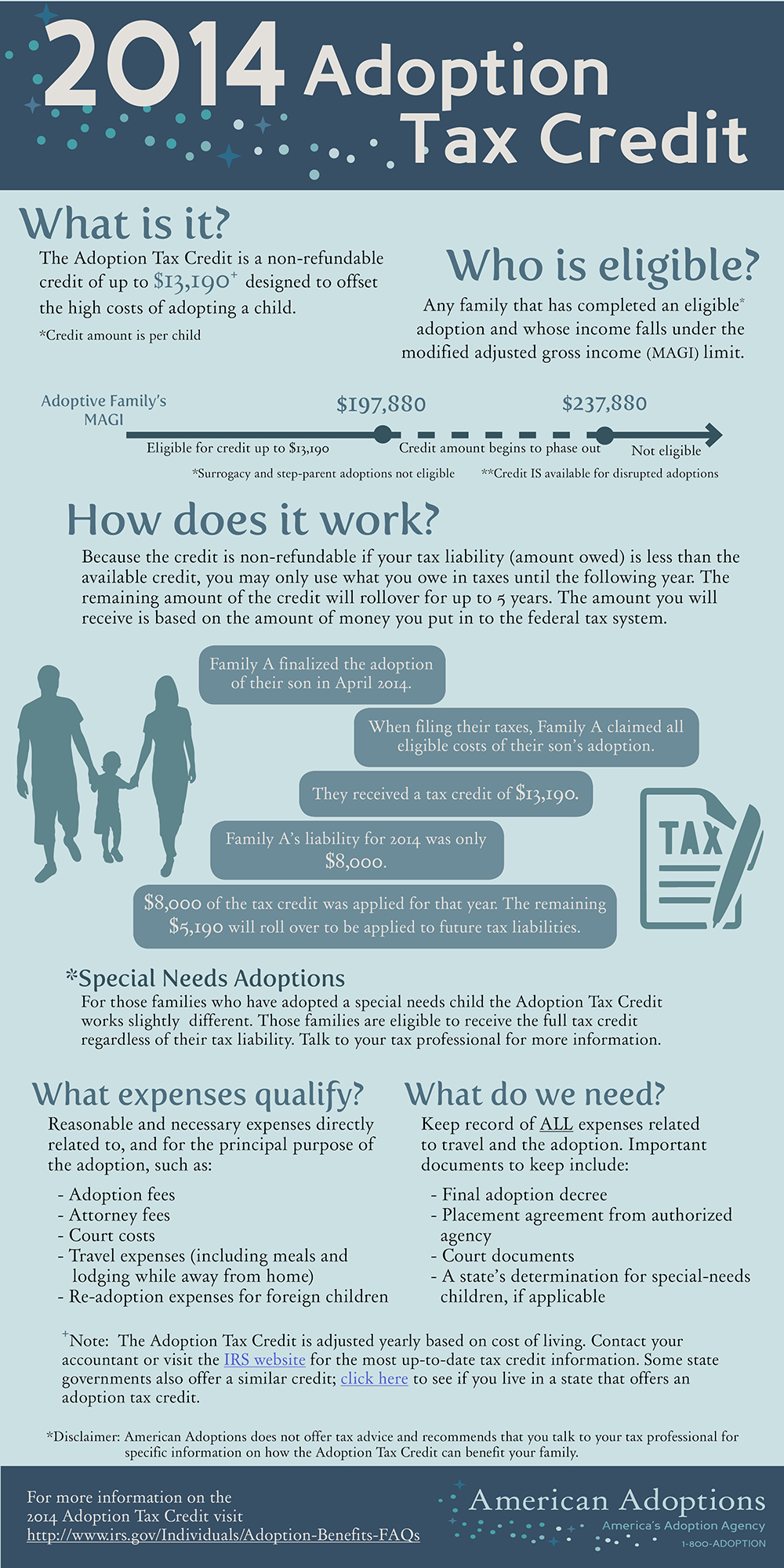

Adoption 101: The Adoption Tax Credit [Infographic] | American

Source : www.americanadoptions.com

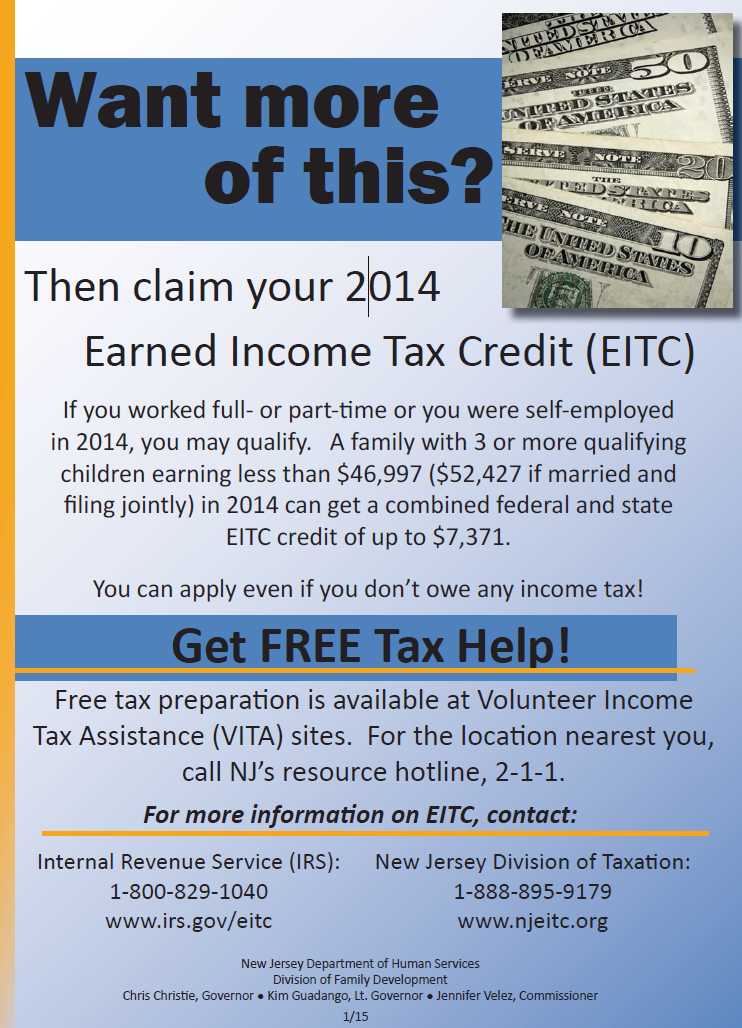

Claim your 2014 Earned Income Tax Credit – County of Union

Source : ucnj.org

Automate Individual tax return Document Processing in 2 minutes!

Source : rossum.ai

A free IRS tax filing software is launching in 2024 — do you

Source : mashable.com

2014 EITC Income Limits, Maximum Credit Amounts and Tax Law

Source : www.caab.org

united states How to make sense of results from the IRS W 4

Source : money.stackexchange.com

Average CDCTC FF | Tax Policy Center

Source : www.taxpolicycenter.org

Solid Gold Coins on 2014 Form 1040 Editorial Stock Photo Image

Source : www.dreamstime.com

10 tax forms you need to know before you file

Source : www.azcentral.com

Child Tax Credit 2014 Irs Child Tax Credit 2021: Here’s when the fourth check will deposit : including an expansion of the child tax credit. As I reported last week, the measure looked ripe for rejuvenation, following a long period of fits and starts in negotiations after the pandemic-era . If you owe the IRS less than the qualified CTC amount, then you can claim the additional child tax credit. The ACTC cannot be claimed if you file Form 2555 or Form 2555-EZ, excluding foreign .